There are several reasons why you may need to fill out a check. For instance, some businesses will give you a discount for writing a check instead of swiping a card.

This is because they will save money by not paying a processing fee.

So if you are going to fill out a check, making sure you are doing it correctly is key if you don’t want there to be a hassle.

To help you with this, here are six simple steps to write out a check correctly.

How to Fill Out a Check

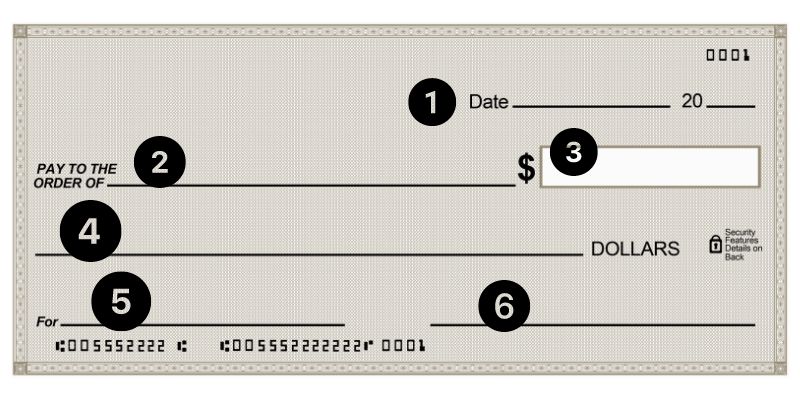

First, notice that the check has numbered fields. Throughout this tutorial, we will discuss each numbered field and its purpose so that you can use the proper check format.

1. Date the check in the top right corner

Any format of date is acceptable. For example, June 1, 2024, or 6/1/2024, or any other format. However, consistency is key as it helps you to more easily recognize a check that may have been stolen from your account.

For instance, if you always date your checks in this format: June 2, 2024, a forged check will easily be identified if the check date is written in a different format.

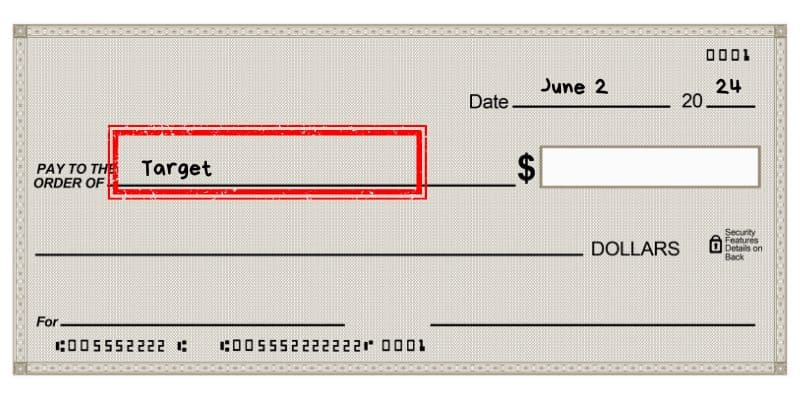

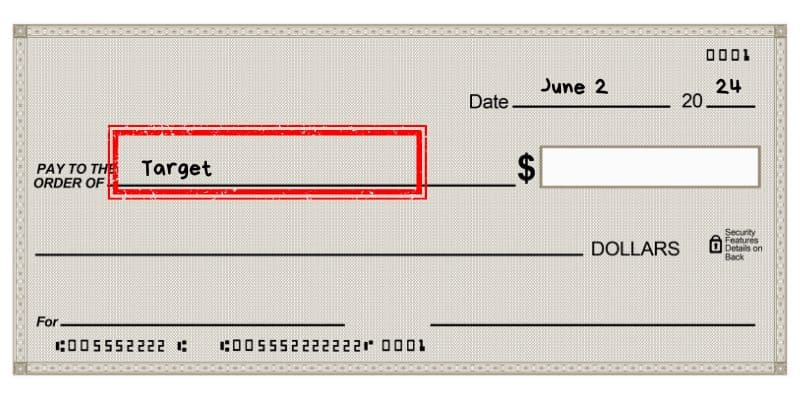

2. Write the name of who you are paying

In the “pay to the order of” field, write down to whom the check is made payable to. In the case of this tutorial, that would be Target.

It is important to write neatly when filling out your check and to include the first and last name or the entire business name of the payee (the person or business to whom the check is being written).

3. Write the amount that you wish to pay in numbers

Again, it’s important to be neat and precise here. Make a clear distinction between dollars and cents with a decimal point or by underlining the cents number in order to avoid confusion about the designated amount.

This confirms the amount in written form so that there is no confusion on how much should be paid. So in this example, it would be $20.21.

4. Write the dollar amount using words

Neatness counts here as well because banks will, on occasion, double check the written amount should they be unable to read the numbers in the amount box.

Write out the dollar amount of the check clearly, as shown in the box below. For this check example, it would be Twenty and 21/100. You do not need to put dollars after the word twenty because it is already listed on the line.

5. Fill in the For / Memo field on the bottom left

People don’t often use the For line when writing a check, but it can be important when it comes to a potential payment dispute. Note: Some banks will use the word “Memo” or “For” in this field.

Whenever paying a bill, we suggest writing the account number in the For line. Or, if the check is for paying rent, write “June 2024 rent” in the For line.

Using the For line when writing a check helps secure your checking account and protect you against possible payment disputes.

It also can be used to help track your spending so you can know how much money you’re spending in each budget area. In this example, it would be Clothes.

6. Sign the check in the bottom right

This is possibly the most vital part of the check-writing process. Companies won’t accept checks without a valid signature. Since each person’s signature is unique, the signature on your check has the capability of protecting you from potential check-writing forgers.

When writing a check, be sure to make your signature neat and write it as you usually would on any other formal document. See Your signature goes here box in the example below.

Your check should look similar to this when it is completed:

There are three more pieces of information that you should be aware of when it comes to the format of a check.

Routing number

This is specific to your banking institution and is found on the bottom left of the check. It is also used when you give your employer information to receive direct deposit as well as setting up automatic payments.

Account number

This is self-explanatory; however, just know that you can find this number directly to the right of your routing number.

Check number

Your checkbook is set up in a numerical sequence, so if you write a lot of checks over the years, it makes it easier to go back and confirm payments and ‘check’ disputes.

FAQ

Only write checks with a pen, preferably blue or black ink. Although you can write checks in pencil, anybody with an eraser can erase all of the information to change the dollar amount and the recipient’s name.

People will typically post-date a check when they know there are not sufficient funds currently in the account to cover the check. They are waiting for a deposit to come in so that the check will not bounce.

They may also post-date the check because that is when the bill is due. You need to be careful because when writing a check because it’s legal tender.

Just because there is a future date on the check, doesn’t mean that a bank won’t cash it on an earlier date.

Two fields make absolutely clear what the amount of the check is supposed to be. Writing the amount twice also helps eliminate fraud as well as the incorrect amount being debited from one’s account.

Now that you know the basics of writing a check, you are prepared for when there aren’t other payment options such as cash or automatic payment.

Yes, you can write a check to yourself to cash it out. In the “Pay to the order of” field, you can write a check to yourself by writing your own name or by writing the word “Cash.”

You will also need to sign the back of the check like you’re going to deposit the check into your checking account.

If you incorrectly write a check, the depositing bank might not accept the check. Many businesses charge returned check fees–between $20 and $40–plus any applicable late fees because they’re not receiving correct payment by the due date.

Occasionally, you will need to void a check if you incorrectly write it or to set up direct deposit with your employer, charity, or automatic monthly bill payments

Just like you write a check in pen, use a pen to write “VOID” on the front of the check. Each person does it slightly differently, as you might prefer to write the word once in giant letters or write the word in each of the five fields.

If you’re writing a voided check to schedule automatic monthly payments or deposits, you usually don’t have to fill in any of the five fields. However, you might decide to write a brief note in the memo for your personal record.

No. A personal check is one that you write by hand with a pen. Certified checks–which are sometimes called official checks or cashier’s checks–are printed by your bank to verify the check has sufficient funds.

Side note: you also may be able to cash a check online as well by depositing through the app of your bank.

Summary

Writing a check might feel like a “lost art,” but it’s still a very important skill to know. We don’t pay for everything with plastic or a digital wallet yet, and many businesses prefer a check to cash for large purchases because it’s more secure.

Now that you know how to write a check correctly, you don’t have to worry about having to rewrite your check or getting charged those pesky returned check fees.

Source link